Saturday, October 29, 2005

The Associated Press's Ron Fournier writes,

The economy has been a baffling issue to Bush and his team. They have not figured out how to convince the public that the economy is doing as well as experts say. It's a hard sell when pension funds are going bankrupt, health care costs and gasoline prices are soaring and jobs are being shipped overseas.

That is, policymakers wonder why even with 3.8% GDP growth are consumers still rather glum. The US economy isn't doing nearly as well as the GDP figure indicates, and consumers should be worried:

(1) Wealth redistribution is going the wrong way - primarily because of misguided income tax, estate tax and capital gains policies, money is going from the pockets of those with less to those with more. Add in surging energy costs which have similar redistribution effects and you can see why Joe Consumer isn't happy.

(2) Consumers are getting squeezed no matter what - do the math...falling incomes and greater expenditures doesn't sound like a recipe for cheerful consumers. Now, the happy talk people might say that the evidence shows consumers are still spending like crazy, so don't worry,

I'll offer two counterarguments, though I suspect there are many more. First, consumers might be loading up on debt now in anticipation of higher interest rates. If the Fed has telegraphed this point clearly, then it would seem to be a "logical" thing to do now to buy flat screen TVs and take out mortgages on dream homes before interest rates head north. The principle is the same as the ridiculous "Employee Discount" promotion that automakers used to shoot themselves in the feet. Consumers are bringing expenditures forward to take advantage of current favorable conditions, so why buy tomorrow when things aren't as favorable? We'll see.

Second, consumers have no real choice in many instances. At the end of the day, you still need to put food on the table, put gas in the car and all that stuff. Sure, they're able to stomach higher prices for a while, but just how much consumer dissavings can they sustain? The tougher bankruptcy laws (passed at the behest of the finance industry) have definitely lowered the pain threshold for consumers, and we're likely to see fallout in the coming months.

(3) Debt needs to be paid - this might be ridiculously obvious, but the free lunch economists seem to ignore this point altogether. Sure you can borrow a lot now at historically low interest rates, but where will you get the money to pay it off in the future while wages are stagnant and prices are rising? Dissavings can only get you so far, and that margin of safety is rapidly shrinking.

(4) GDP is an imperfect measure of economic progress - it hides the deleterious effects of debt in many instances. So, you can induce spending to the high heavens in vain pursuits like housing and unlimited consumerism, but of course it misses the earlier point. You can have your cake and eat it too at the moment, but all debts must be paid in full when tomorrow comes, and GDP doesn't account for that.

Monday, October 24, 2005

Markets seem to be rather overjoyed that the Greenspan-lite choice to replace "The Maestro" is none other than Ben Bernanke. The main difference between him and Greenspan is that he has a more favorable view of inflation targeting. (The much-maligned EU does pretty much the same.) What is more worrisome is what the markets seem to like--that he is much alike Greenspan. The soon-t0-be retired Fed Chairman has, in recent years, barely raised objections as budget and current account deficits have spiraled out of control while belatedly acknowledging the presence of froth in parts of the housing market.

So, what matters most will be his ability to get these "twin deficits" under control, and particularly to induce a "soft landing" from the

"Bretton Woods II" system of American debt lust. If he sticks to a Greenspanesque course without demanding concrete improvements on these fronts, the folly of Greenspan's actions in the Dubya era will come to fore during his term.

As The Who once sang, "Meet the new boss--same as the old boss!"

Thursday, October 20, 2005

Today's

133 point drop in the Dow Jones Industrial Average (DJIA) is no surprise to hardcore bears like myself. What's more surprising is that the DJIA rose 128 points the day before. Now, explanations for this (deviant) behavior can be offered:

(1) Bottom-picking: Those bargain-hunters who were looking for bargains seem to have reversed their (inscrutable) logic the day after. Honestly, the bottom hasn't fallen out of the sky just yet. A sustained drive below 10,000 or worse on the Dow looks

quite likely, given that maybe only true believers of Cheneynomics are still under the illusion that this is the best economy of our lifetimes. Hallucinogens are such wonderful investment aids--as long as you're not interested in making money.

(2) False expectations: Again, some people are prone to taking a few positive signals and concluding that everything's going to be alright. So what if GM had another round of miserable earnings. They were coming to terms with the UAW, dammit. So what if Intel didn't see things looking so profitable going forward. Oil prices were falling, dammit. People have an almost endless capacity for self-delusion. Too bad that the next day, Ford decided to do a GM and report losses together with additional layoffs. On top of that, Pfizer got Mercked into reporting underwhelming sales. Even the rather

useless and inaccurate Conference Board leading economic indicator index fell by 0.7%. All is not well in Greenspan's Bubbleland, and things are bound to get worse once he abdicates his throne and the lemmings start worrying.

(3) Faith-based investing: Don't worry, Mr. Investor. The "Chosen One" Bush will pump prime the economy after Wilma naturally juices all the oranges in Florida. Don't be

so damn negative; spend all you've got and everything will be alright. You can have your cake and eat it too. To paraphrase Kennedy, why save for tomorrow what you can spend today? It's no pain, all gain in this rosy Bushworld.

Reality is such a nuisance.

Friday, October 14, 2005

With apologies to Chuck Berry:

Out here in Arizona close to New Mexico In the barren desert near the Navajo There stood a McMansion made of steel and wood Where lived a city slicker named Johnny B. Lewd Who never learned to save or budget so well But he could splurge on credit really damn swell

Years from now, the US consumer of the early 21st century will be studied by anthropologists, and they will laugh oh-so-hard at his manically illogical behavior. His spending accounted for nearly 70% of the US economy, buying up everything with little regard for anything else. He took particular delight in selling houses to his peers with money borrowed from the Chinese, and this unproductive behavior accounted for about 40% of all job creation after the semi-apocalyptic events of September 11, 2001. In addition to houses, he bought far more than he needed, and even borrowed against the value of his home(s) to get more money to spend himself silly.

These anthropologists will perhaps note October 14, 2005 as a pivotal moment in the devolution of

Spendthriftus Americanus. He spent well beyond his means, pretty much oblivious to everything going on around him including global fundamentalist religious conflict, twin deficits, major calamities, corporate malfeasance, and US-led wars of convenience. On this day, though, his limited capacity for understanding the world around him was awakened to a greater degree than usual. His

weekly take-home pay fell 1.2% while

consumer price inflation rose 1.2% (the biggest advance in half a century), meaning that he had less money to spend on essentials like

iPod Videos and Paris Hilton home movies.

In a semi-climatic episode, he began to shout at the devil: "Why the #$@% am I running out of money? I am the consumer--the King of America!" The reply was quick in coming. The devil said, "Well, sonny, it's the end of free money. The Demon-Fed needs to cut down on the nonsense they've created in the first place, and it doesn't particularly care that

personal bankrupties and consumer dissavings are at an all-time high."

Spendthriftus Americanus was horrified as the devil let out a demented laugh and said he had to go collect

Karl Rove's black heart or something to that effect then vanished in a great ball of fire. Bemoaning his lot, the consumer's confidence hit its

lowest point in 13 years at 75.4. In his heart of hearts, he knew that the party was very nearly over and cried himself to a fitful sleep.

I've been railing for months now about the twin phenomena of dementia in the US auto industry known as "Employee Discounts" and overreliance on SUVs in an age of consumer price inflation led by gasoline. The problems with these insane giveaways are manifold. I recount them briefly here:

(1) Automakers depress resale values by offering discounts piled on top of incentives piled on top of discounts. As long-term ownership propositions, the money "saved" by buying these cars at fire-sale prices is lost because their resale values are markedly diminished.

(2) Brand equity is lost. What kind of pride of ownership is there in owning makes that are enthusiastically being hawked like fake Rolexes on Main Street? Shame is the name of the game.

(3) Sales were moved ahead by these discounts. Now that the promotions are gone, the bargain-seekers are too.

(4) By offering these discounts, consumers are conditioned to look forward to more giveaways. If US automakers treat sticker prices like a running gag, then consumers will too.

The end result is

rather terrible for domestic automakers:

Retail new-vehicle sales were down 33 percent across the industry in the first nine days of October compared with the same period a year ago, the Power Information Network said. It said results were down at nine major automakers, but GM led the pack with a 57 percent decline followed by Ford, which saw its retail sales drop 45 percent over the first nine days of the month.

The Chrysler arm of Germany's DaimlerChrysler posted a 32 percent drop over the same nine-day period compared with year-ago results.

Meanwhile, those not dumb enough to follow suit are suffering less, as expected:

The U.S. arm of Honda Motor Co. Ltd. posted the smallest drop, with retail sales down just 8 percent, followed by Toyota Motor Corp., with sales down 14 percent.

The long-predicted demise of GM, like that of its Delphi affiliate, will not be too far away if it can't come up with products more in tune with the times, like really usable hybrid vehicles. Ford is in somewhat better shape, but isn't turning the ship around by any means. Why they stick to a strategy of lowballing massive SUVs few really want is beyond all reason.

Sunday, October 09, 2005

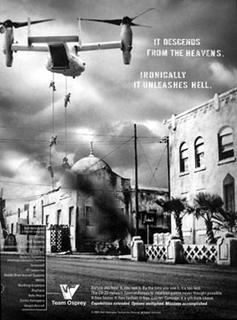

Sometimes, defense contractors simply bilk the government, a la Halliburton. Other times, they both bilk the government and manage to create offensive advertising at the same time. The recent case of Boeing and Bell provides such a double whammy. The gestation of the V-22 Osprey tilt-rotor aircraft has been long and troubled.

23 Marines have been killed in its development. Also, its history is not marked by cost effectiveness either, to

no one's surprise.

It's understandable then that Boeing and Bell were rather ecstatic when the Osprey finally completed its tests successfully and was

cleared for full production. Boeing and Bell initially caught flak with running the pictured ad a month ago in the

Armed Forces Journal. Not wising up, they then ran the very same ad just last week in the

National Journal--by mistake, or so they claim. The Council on American-Islamic Relations (CAIR) was offended by the image of "hell" being a mosque coming under siege, presumably by American troops from "heaven". Of course, this sort of thing is excellent fodder for jihadists--American companies reaping profits by blowing up mosques appears to be the perfect recruitment tool. Will the tilt-rotor aircraft revolutionize fighting as its proponents claim? Well, it may be the case that it first manages to revolutionize young Islamic men into becoming fighters.

Wednesday, October 05, 2005

With the Fed putting the pedal to the metal, damn everything else, the stock markets aren't exactly prospering at the moment. The DJIA is down over 210 points over the past two days, and the Nasdaq isn't doing any better. I noted a while back that the Fed would continue on its "measured pace" of 25 bp hikes if it was serious about controlling asset price bubbles, regardless of the consequences. Indeed, it's a bitter pill to swallow courtesy of Greenspan and friends, but it's necessary in order to regain a measure of sanity. That is, it's better to reduce consumer dissavings and speculation in property markets than risk possibilities like a one trillion dollar current account deficit in 2006 and mass personal bankruptcies reminiscent of the S&L debacle. (On second thought, scratch the latter: it's likely to happen anyhow.)

What's evident now is the flimsiness of the so-called recovery post-9/11, fuelled as it is by relatively unproductive pursuits such as consumerism gone wild and housing mania. As the Fed ratchets up rates, consumers have hit a wall, and housing has suffered from the prospect of consumers facing significantly bigger monthly payments and stagnant to falling house prices. As many have pointed out, consumption and construction are pursuits that basically do nothing to narrow the current account deficit and are instead drivers of further widening. Why Greenspan waited this long to douse everything with cold water is beyond me. So much for"The Wizard of Bubbleland" retiring on a high note. This tightening cycle should have begun long ago, and if it did, the results wouldn't have been as spectacularly explosive as we're likely to see.

^